Ira calculator 2021

Individuals will have to pay income. There are many IRA account types to consider as you plan for retirement and each works differently depending on your life circumstances and financial goals.

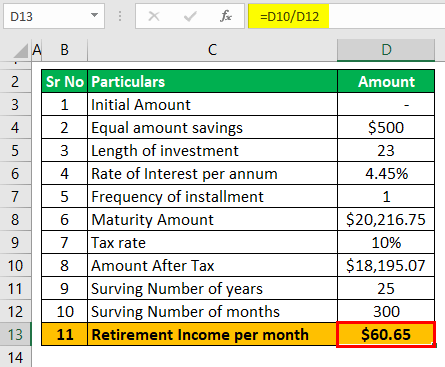

Retirement Income Calculator Step By Step Easy Guide

When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum withdrawals you must take.

. Account balance as of December 31 2021 7000000 Life expectancy factor. Request Your Free 2022 Gold IRA Kit. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track.

For instance if you expect your income level to be lower in a particular year but increase again in later years. Enter your current IRA balance. Please visit our 401K Calculator for more information about.

Unlike taxable investment accounts you cant put an. Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year. Calculate the required minimum distribution from an inherited IRA.

Ad Help Determine Your IRA Contribution Limit With Our Tool. For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021. Enter the percentage of your expected rate of return the.

Traditional IRA Tax Deduction Income Limits in 2021 and 2022. 0 Your life expectancy factor is taken from the IRS. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

Enter the amount of your contributions per year. Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals. Ad Visit Fidelity for Retirement Planning Education and Tools.

Calculate your earnings and more. The threshold is anything. Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth.

The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. Enter the number of years until your retirement. Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly.

Converting to a Roth IRA may ultimately help you save money on income taxes. By thousands of Americans. Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation.

Only distributions are taxed as ordinary income in retirement during which retirees most likely fall within a lower tax bracket. The calculator will estimate the value of the Roth IRAs tax-free investment growth by comparing your projected Roth IRA account balance at retirement with the balance you would have if you. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from.

Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You. Claim 10000 or More in Free Silver. While long term savings in a Roth IRA may produce.

How is my RMD calculated. Protect your retirement with Goldco. It is important to.

Required Minimum Distribution Calculator. This guide may be especially helpful for those with over 500K portfolios. Ad Visit Fidelity for Retirement Planning Education and Tools.

Use these free retirement calculators to determine how much to save for retirement project savings income 401K Roth IRA and more. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your.

If you want to simply take your. If inherited assets have been transferred. Calculate your earnings and more.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. This calculator assumes that you make your contribution at the beginning of each year. Get started by using our.

Traditional and Roth IRAs give you options for managing taxes on your retirement investments. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Use our IRA calculator to see how much your nest egg will grow by the time you reach retirement.

Ad Its Time For A New Conversation About Your Retirement Priorities. Ad Top Rated Gold Co. RMD amounts depend on various factors such as the decedents age at death the year of death the type of beneficiary the account value and more.

Roth Ira Contribution Limit 2021 Calculator. Ad If you have a 500000 portfolio download your free copy of this guide now.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

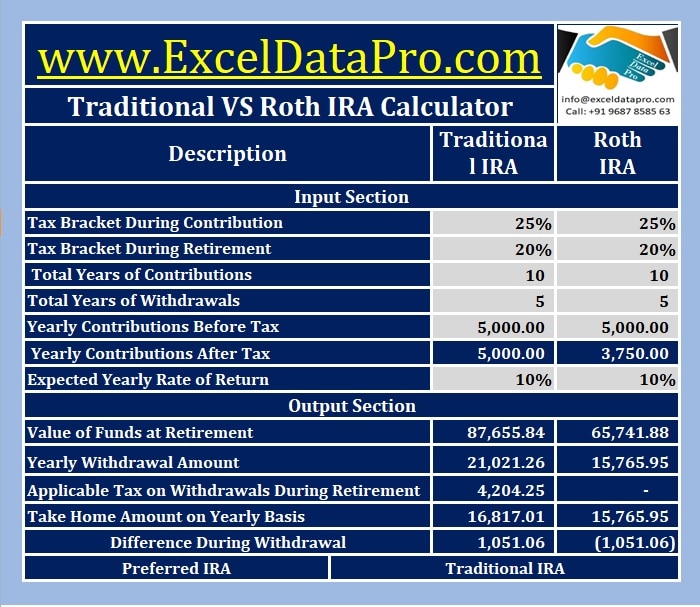

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Excel Formula Calculate Retirement Date Exceljet

Ira Calculator Forbes Advisor

Roth Ira Calculator Calculate Tax Free Amount At Retirement

The 10 Best Retirement Calculators Newretirement

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Roth Ira Calculator Excel Template Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Fire Calculator When Can I Retire Early Engaging Data

This Could Be The Perfect Stock For A Roth Ira Nyse O Seeking Alpha

Retirement Age Calculator With Printable Schedule Chart

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Ira Calculator See What You Ll Have Saved Dqydj

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

The 10 Best Retirement Calculators Newretirement