Farm equipment depreciation calculator

Personal Property includes boats and motors tractors farm equipment and machinery. So if you bought your sofa for 1000 a few years ago but its now only worth 250 due to age and wear and tear you would receive 250 from the insurance company.

Revaluation Method Of Calculating Depreciation Accounting Simpler Enjoy It Method Calculator Accounting

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

. See chapter 3 of Pub. HOME PROVIDERS DOCUMENTS NEWS CAREERS EVENTS TOOLS STORMWATCH TECHNOLOGY. Depreciation is a non-cash cost that reflects the loss in value of an asset due to age wear and obsolescence.

225 Farmers Tax Guide. The results for the propertys estimated depreciation for the first five years are separated into Plant Equipment removable assets and Division 43 capital works allowance. Learn more about this method with the units of depreciation calculator.

A poultry farm purchased for 21 million. Plant and equipment assets division 40 are items which are easily removable from the property like carpet and blinds. Anywhere the BMT Tax Depreciation Calculator is an indispensable tool for anyone involved in property investing.

Ownership of personal property is established January 1 of each year. The second chart the Percentage Table Guide asks for the convention month or quarter that you placed the Toyota in service. If the business use of the computer or equipment is 50 or less you cant take a Section 179 deduction or MACRS.

AED is an international trade association representing companies involved in the distribution rental support of equipment. Explained in chapter 8 under Depreciation for an asset and before the end of the assets recovery period the percentage of. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2021 is 18200 if the special depreciation allowance applies or 10200 if the special depreciation allowance does not apply.

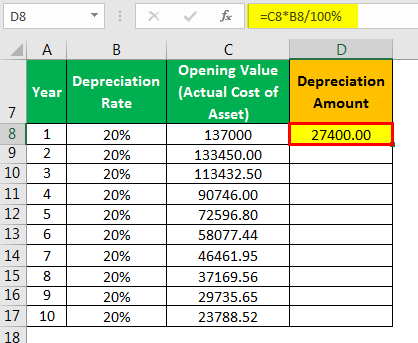

Depreciation limits on business vehicles. If you or the other driver in the accident have auto insurance to cover your vehicle then the. The cells outlined in red automatically calculate your.

For the depreciation schedule for computers and computer equipment depreciation you may claim a deduction under Section 179. Labor and overhead allocation. This takes into account the cost of replacing your items minus depreciation.

Total cash cost per acre and cost per farm are calculated. Boats single-purpose farm structures. And remember anything tucked out of sight such as.

The average cost basisbase value is purchase price minus accumulated depreciation for purchased breeding stock. These assets have a limited effective life as set out by the ATO and can generally be depreciated over time. Use the alternate depreciation system instead.

Buying used farm equipment is a smart move if you want to save some money. The Bonus Depreciation is available for both new and used equipment. A poultry farm purchased for 21 million.

For more details on limits and qualifying equipment as well as Section 179 Qualified Financing please read this entire website carefully. The Depreciation Calculator computes the value of an item based its age and replacement value. Diminished value refers to the difference in your cars market value before and after the accident.

Both of these investments have an initial cost of 500000. This is the straight-line method. Include outdoor furniture and personal belongings such as a barbecue grill collectibles musical instruments and hobby or sporting equipment.

Generally MACRS depreciation is calculated assuming that all assets are placed in service during the middle of the year referred to as the half-year HY convention. CT-647-I Instructions Eligible Farm Employee Information for the Farm Workforce Retention Credit CT-2658 Fill-in 2017 CT-2658-I Instructions Report of Estimated Tax for Corporate Partners - Payments due April 18 June 15 September 15 2017 and January 16 2018. Farm Workforce Retention Credit CT-647-ATT.

Determine Whether the Mid-quarter MQ Convention Applies. If you own a business furniture fixtures equipment inventory and supplies are considered personal property. The canceled debt is a qualified farm debt owed to a qualified person.

You can make changes to the interactive PDF equipment calculator for this publication by inputting your own costs and interest rates in the green outlined cells for any item. Four tables are included in this worksheet for data entry. Machinery equipment and facilities.

Remember you can write off a total of 9500 or 100000 hours. However when you start shopping its easy to get overwhelmed. BMT Tax Depreciation Calculator.

The first chart the MACRS Depreciation Methods Table tells you your Toyota is a non-farm 3- 5- 7- and 10-year property and that you use the GDS 200 method to calculate how much tax to deduct. Get 247 customer support help when you place a homework help service order with us. These items have been filtered to our Appliances - Major category.

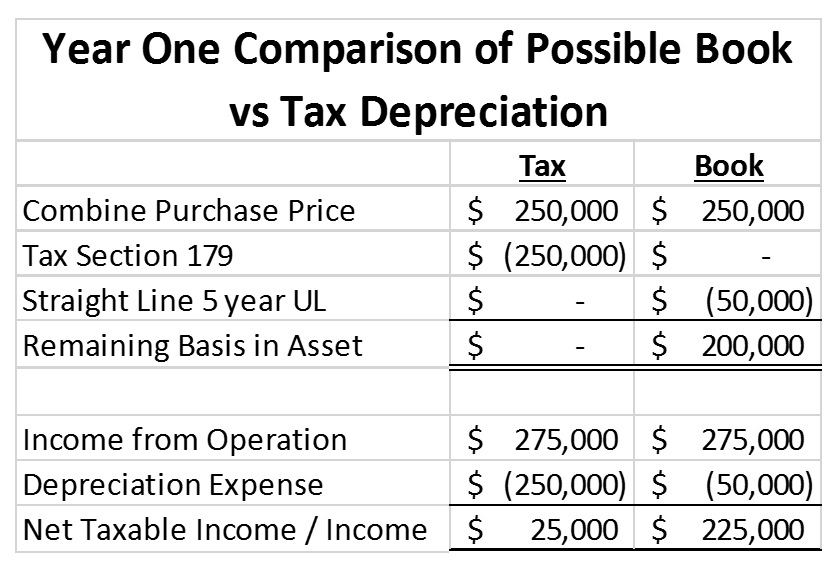

The above is an overall birds-eye view of the Section 179 Deduction for 2022. It has a five-year. There are many variables which can affect an items.

Use various kinds of equipment facilities or products. Modified accelerated cost recovery system. Thomson Reuters Step 3.

Office furniture and fixtures farm equipment any assets that dont fit into other classes. Solar and another equipment investment say a machine that produces widgets. Well compare two equally priced equipment investments.

But with 100 bonus depreciation you also get all the benefits in year one which can really help with installation costs. Read more about our services. Plant and equipment depreciation.

Receive payment for certain services. The calculator should be used as a general guide only. Youll be able to use depreciation in your favor to get the machines you need at an affordable price.

Used Farm Equipment Buying Guide.

Accelerated Depreciation And Machinery Purchases Farmdoc Daily

Macrs Depreciation Calculator With Formula Nerd Counter

The Silver Lining To Used Equipment Prices Farming Organic Farm Farmers Farmersmarket Agriculture Ou Successful Farming American Agriculture Agriculture

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

The Impact Of Power And Equipment Costs On Illinois Grain Farms Farmdoc Daily

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Depreciating Farm Property With A 20 Year Recovery Period Center For Agricultural Law And Taxation

Methods Of Calculating Depreciation Accounting Simpler Enjoy It Method Calculator Accounting

Depreciating Farm Property With A 15 Year Recovery Period Center For Agricultural Law And Taxation

2018 Tax Reform What It Means For Agriculture

Pin On Agricultural Machinery

Depreciation Formula Calculate Depreciation Expense

Computing Machinery Ownership Costs Farmdoc Daily

Depreciation And Farm Machinery A Rule Of Thumb Grainews

A Small Farm May Be An Ongoing Family Venture Or A New But Growing Business That Will Eventually Become A Full Time Sou Grow Business Tax Write Offs Small Farm

Depreciation What It Is And How To Use It Cropwatch University Of Nebraska Lincoln

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation